Allison Parker, Director of Gift Planning and Impact Investing Lead, Seattle Foundation

In the weeks leading up to the 2015 U.S. Open, professional golfers from around the world converged on Washington's Puget Sound region to practice at Chambers Bay. Before the competition, these players wanted to understand the complexities of this links-style course, reputedly more challenging than the others they’ve played. They wanted to get a lay of the land: alluring with breathtaking views, but filled with hidden bumps, tough climbs and other potential hazards.

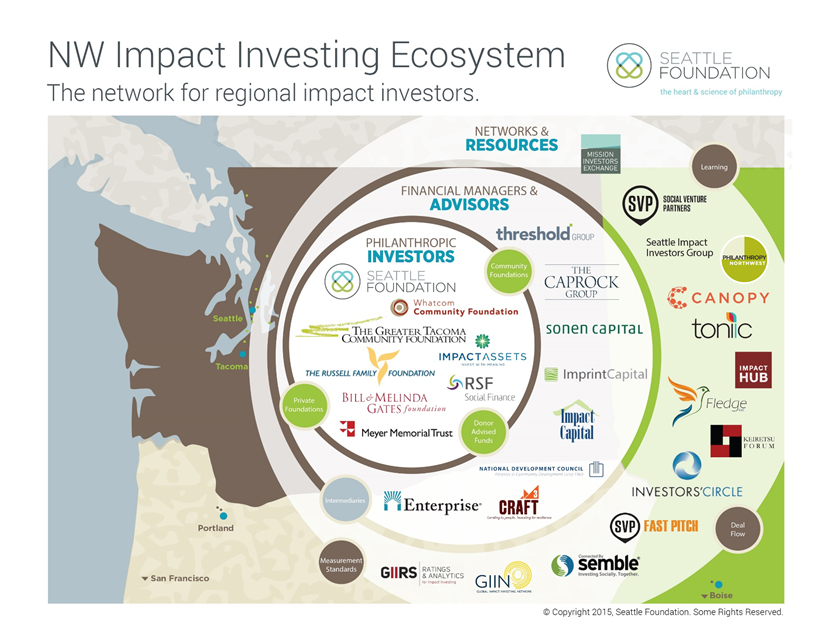

Our region’s impact investing network is a similarly complex course. Similar preparations are needed to navigate any regional impact investing ecosystem, especially for community foundations connecting funders with projects. The number of players — some investing both inside and outside of the region (and some internationally) — and the pace of innovation makes our ecosystem particularly complex.

In developing The Seattle Foundation's Impact Investing "2.0" program over an 18-month period, we’ve talked with every major impact investing stakeholder in the greater Puget Sound area and many operating throughout the Pacific Northwest. Whew! Together with Jane Repensek, our senior vice president of finance and operations; Michael Brown, our vice president of community programs; and Fraser Black, vice-chair of our board, we concluded the region has a robust yet still-fragmented ecosystem.

By mapping out this ecosystem, we see that The Seattle Foundation’s role is to build on our strengths as a community foundation: sharing place-based knowledge, building relationships and engaging donors. Our work includes connecting intermediaries, such as local CDFI Craft3, with donors and commercial investors. We’ve introduced Mission Investors Exchange’s resources to learning cohorts of private investors, and encouraged other philanthropies and nonprofits to check out SVP Fast Pitch (an annual favorite among our donors). And our partners at Philanthropy Northwest continue to provide thought leadership for the impact investing ecosystem from Alaska to Wyoming.

We also need to keep up with new players and emerging innovations. Last month, Canopy entered the field, aiming to bring together “nonprofit institutions, for-profit organizations and individuals to leverage capital in building a regional investment ecosystem that benefits communities and creates financial returns." Canopy is poised to play a significant role in shaping the regional ecosystem, and as it continues to evolve, we’ll be enhancing our ecosystem infographic into an interactive online resource for others to use and learn more about strategic partnerships.

The Seattle Foundation is excited by the synergy this will foster in our region. By connecting the disparate parts of this impact investing ecosystem, we don't recreate any wheels or duplicate efforts, but rather foster more local investment.

Getting to the green

In my last blog post, I described a current impact investment opportunity: Bellwether Housing's Seattle Futures Fund. They exceeded their first-round fundraising goal of $1 million and have now raised the entire $1.8 million needed to build affordable housing units for 50 families. Five Seattle Foundation donors invested a total of $225,000; four of them are new to impact investing with their donor-advised fund. Bellwether estimates an additional $150,000 in private investment was the result of investors learning about the opportunity from The Seattle Foundation.

In U.S. Open terms, the Bellwether Housing impact investment were our first two rounds. We've made the cut, and the green is clear for making the winning putt that could change the face of impact investing with community foundations.

Allison Parker has worked for The Seattle Foundation since 2006; she currently serves as Director of Gift Planning, and Impact Investing Lead. This is the second post in her bimonthly blog series about mission investing.