If we want to catalyze a thriving food economy in the Pacific Northwest, where should we invest our philanthropic funds? Cascadia Foodshed Financing Project (CFFP) commissioned Ecotrust to research this question — and the results have revealed intriguing insights for our regional food economy, venture philanthropy and impact investing.

Forming the Question

At CFFP, we recognized a need for targeted, innovative market research after our first investment project. While that project did generate actual investments, it mainly clarified our interest in identifying and supporting strategic enterprises. We realized this need just as Ecotrust was finalizing the Oregon Food Infrastructure Gap Analysis, a 15-month study funded by our partner and Philanthropy Northwest member Meyer Memorial Trust. That report provided solid evidence that mid-scale producers, “Ag of the Middle,” need key infrastructure to compete with market players.

Sayer Jones, Meyer’s director of finance and mission related investing, shared the reaction of a farmer advisor to that research: “This research is very compelling, but I just want to know why my product is more expensive when it hits the loading dock.” To investigate this question, Ecotrust conducted a quick case study examining the production costs of pastured chicken. CFFP then commissioned Ecotrust to build out that case study and take their infrastructure gap analysis to the next stage: researching six product categories (no-till grain, grass-finished beef, organic greens, organic storage crops, pastured chicken, and hoop house pork) to identify differentiated and viable production systems aligned with our five overarching principles of health, social equity, family wage job creation and preservation, rural community resilience, and ability to influence policy.

System and Enterprise Opportunities

Our research reveals three outcomes that have the potential to impact different regional and national efforts related to food systems and impact investing.

Our research reveals three outcomes that have the potential to impact different regional and national efforts related to food systems and impact investing.

The first outcome involves a better understanding of which values-aligned products are viable in the Pacific Northwest. Insights include:

- In wheat and small grains, we have an opportunity to help expand the market for no-till wheat through educating the market about rotation grains.

- A sensitivity analysis of pastured chicken showed that farmers can pay a livable wage to all workers when they secure feed at $700 per short ton, but not at $1,100. Both prices are within recent market fluctuations.

- While overall demand for beef is on the decline, grass-fed beef segment is generating more demand.

- There is limited opportunity for mid-scale organic leafy field-grown greens in the region, but indoor hydroponics appears to merit attention.

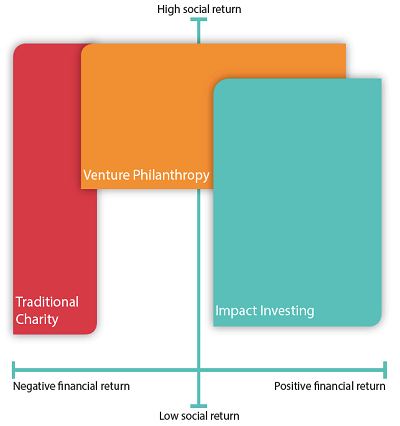

The second outcome was less expected and sheds light on a creative tension we have sensed within the impact investment space, predominantly involving the expected returns from an investment.

As the research was developing, we sought feedback from more conventional investors. Because conventional lenders have different goals than foundations, we asked Mark Bowman, an independent financial analyst with more than 25 years experience in agriculture and food system lending, to review the research, highlight key market facts and provide investment recommendations that looked promising from a professional lender’s perspective.

This confirmed that entities with different end-goals may draw different conclusions from the same research. Ecotrust’s Food and Farm program is focused more on food systems change to advance sustainability and equitable access to healthy food; Bowman helps investors pick winners via investments in enterprises that provide profit and capital preservation. For example, systems change efforts may see opportunity to increase grass fed beef production since there is demand for this niche product that can improve the health of soil. On the other hand, enterprise success efforts may focus on an overall declining market for beef and therefore see higher risk related to beef investments. This creative tension between “system change” and “enterprise success” was not visible at first — but seems obvious now.

Since CFFP works with both foundations and private investors, we work to advance both perspectives. Using a broad definition of investment, foundation grant investments support systems change efforts. Using a traditional financial definition of investment that is normally limited to loans or equity, investors seek viable enterprises within the sustainable food systems sector. Our work is to bring these two realities together in to a cohesive strategy.

Since CFFP works with both foundations and private investors, we work to advance both perspectives. Using a broad definition of investment, foundation grant investments support systems change efforts. Using a traditional financial definition of investment that is normally limited to loans or equity, investors seek viable enterprises within the sustainable food systems sector. Our work is to bring these two realities together in to a cohesive strategy.

The third outcome of the research involves our overarching strategy. The week before we received our completed research, the Toniic Institute, in conjunction with the Shell Foundation, released the report “Venture Philanthropists & Impact Investors: sharing collaboration successes and challenges," defining complimentary interests between venture grantmakers and impact investors. It suggests that philanthropists play an important role when they are willing to take high-risk positions in enterprise development, using structures that are a hybrid of loans and grants. The week after we received our research, the annual forum for the Sustainable Agriculture and Food Systems Funders held a "Bridging the Finance Gap" workshop that discussed the strategic role of philanthropy in financing. This serendipity tells us that different interests are identifying a strategic use of grants alongside investments.

What's Next?

We want to achieve system change to increase more sustainable food production and to build resiliency in rural communities. We want to support enterprise success so that rural communities can generate livable wage jobs and investors can at least preserve capital. We now know where we can do each; we seek the opportunity to do both.

We're asking a new question: How can we advance system change by supporting success at the enterprise level?

This brings CFFP to our next phase of work: Identify or develop a financing vehicle that uses the research and supports our strategy. CFFP will now explore whether a venture philanthropy fund can be built to serve the intersection of system change and enterprise-level success. We are just beginning to determine how this fund would work. It seems clear that it will combine traditional return-oriented investing with “venture philanthropy” vehicles like those being promoted by Toniic.

At this juncture, we're seeking input from interested parties. How does this research inform your work? Do you know an enterprise that would benefit from this research and focus? What would it take for you to participate in a "venture philanthropy" fund? You can reach me through the Comments section on this blog post, by email or at Philanthropy Northwest's conference in Missoula, Montana from September 13 to 15, 2016.

Tim Crosby is project coordinator of Cascadia Foodshed Financing Project on Philanthropy Northwest's incubation platform. He will be presenting this research during an impact investing session at our conference next month, Under One Sky in Missoula, Montana.