As Cascadia Foodshed Financing Project works at the intersection of food, finance, and philanthropy to transform the Pacific Northwest regional food system, we ask the question, “how good is good enough?” With regards to individual investment opportunities, does the investment meet a need expressed by the community? What ripple effects might the investment have?

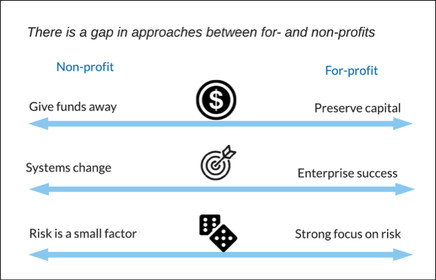

In a recent report, In Pursuit of Deeper Impact, social impact advisor Katherine Pease of KP Advisors challenges the status quo of impact investing as “conventional impact investment practices often fail to incorporate an analysis of the root causes of inequality." As a result, impact investing works often as a series of isolated transactions that yield measurable positive social and environmental outputs, but fail to contribute to the transformation of deep and systemic causes of inequity. This is a tension that resonates with the logic and model gap between investment for enterprise success and systems change that CFFP uncovered through market research analysis with Ecotrust in 2016:

So what can we do, as impact investors who are serious about laboring towards deep and lasting transformation in our food system?

This report submits practical recommendations for investing towards deep social equity — some of which are totally in line with CFFP’s current approach, and some from which we could benefit to learn. The recommendations are informed by the work of leaders and field-builders in impact investing and impact evaluation, including the GIIN, Ford Foundation, RSF Social Finance, and Sonen Capital among others. Scattered throughout the report, case studies from funds and philanthropies around the globe present the challenges and triumphs of taking on such strategies. Overall, we get a very down-to-earth picture of what it looks like to invest for deep and lasting social equity.

Our Current Approach and Remaining Questions

Here are some highlights that speak to CFFP’s current approach and our remaining questions:

- Align philanthropic and for-profit capital. This is a strategy that can leverage several other strategic wins for investing in systems change. First of all, layered capital is a means to rethinking and restructuring of risk as well. The Gates Foundation will layer grant funds with PRI dollars in a form of “RiskShare” when the social benefits of an investment seem to outweigh the financial risk. Additionally, integrated capital can affectively leverage additional investors and resources that might otherwise not engage:

“We continue to iterate on blending capital to ensure that when we use subsidy, if applicable, we do so in a manner that efficiently and effectively addresses gaps and leverages other investors. The goal is to crowd in versus crowd out investors, in an effort to contribute to long-term investment solutions to social challenges”

– Christine Looney, Ford Foundation

- Develop investment theses with social equity as the main driver. Center your outcome goals explicitly around social equity, and your activities and investment decisions will fall into line similarly. Evaluation of the long-term and systemic outcomes of an individual investment is a realm that remains unstandardized, messy, and daunting for many impact investors. However, measurement of outputs and engagement with beneficiaries can, at minimum, help us to learn internally and improve our investment strategies.

- Decrease the gulf between capital holders and recipients by involving the beneficiary throughout the investment process. CDFIs are often regarded as the gold standard here, because they are required by law to incorporate beneficiary perspectives onto their boards. However, Antony Bugg-Levine, president of Nonprofit Finance Fund, points out that the composition and structure of CDFI’s don’t often foster true community engagement:

“The CDFI community has largely been led by a technocracy, not by the communities affected. We are much whiter, more educated, more male – and that’s been a fundamentally patronizing power dynamic that doesn’t instinctively act towards aspects of social equity.”

Engaging Beneficiaries Along the Way

It is essential to engage true beneficiaries because they are the experts on issues in their community, challenges faced, factors for success, and desired solutions. There are many opportunities to engage beneficiaries throughout the investment process:

- Developing the investment thesis or theory of change

- Assessing opportunities and gaps within communities

- Creating investment strategies

- Determining benchmarks for assessing success and impact

- Evaluating individual investment opportunities

We will continue exploring strategies for deeper impact and investments that contribute to systems change in the full report.

Haley Millet is a project assistant for Cascadia Foodshed Financing Project, a Philanthropy Northwest-sponsored collaboration of foundation and individual impact investors seeking to use market-based strateiges to grow the Northwest's regional food economy.