Jeff Clarke, CEO

When talking about advocacy or policy, we often immediately think in terms of federal or state levels of government. But while the vast majority of policy is generated at the state level, from Whatcom County, Wash. comes a stark reminder of why it's important to monitor local initiatives as well.

In March, the Whatcom County Charter Review Commission decisively voted down (12-2) an amendment to the Whatcom County Charter to prohibit funding nonprofits broadly defined as “charitable, educational, civic, homeowners, neighborhood, arts, trade, business, religious or scientific nonprofit organizations, or any other similar types of community organizations.” The goal of the amendment was to confirm that county government bore no responsibility to “provide welfare for those types of services.”

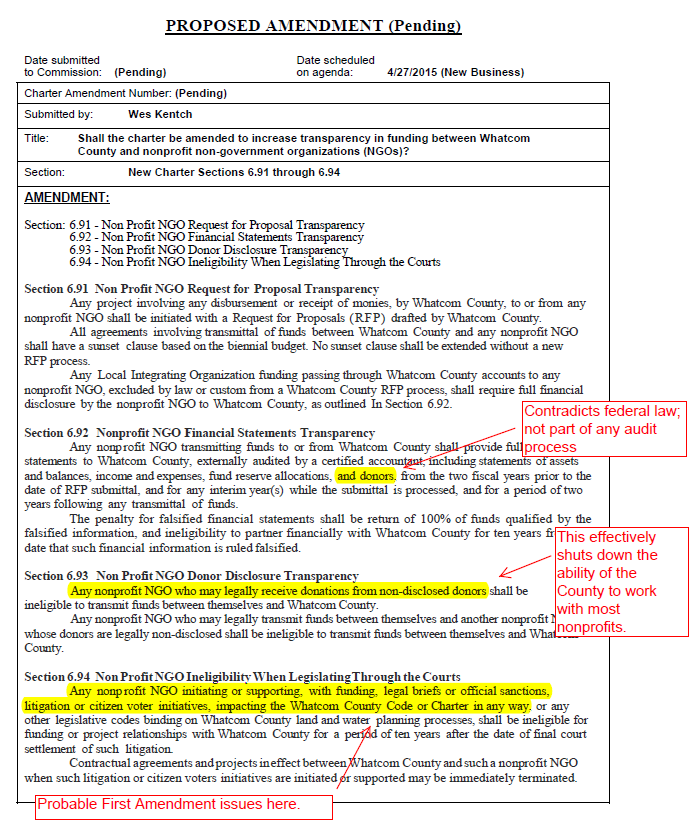

One of the two supporters of the failed amendment immediately introduced a successor amendment, which may be debated by the commission next month. The new proposal asks “shall the charter be amended to increase transparency in funding between Whatcom County and nonprofit non-government organizations (NGOs)?” It’s a seemingly benign question. After all, who isn’t for more transparency in the public sector? However, this proposal is clearly not about transparency. It is also not about best practice for all entities with which a county may conduct business. It’s about erecting barriers to the provision of “those types of services” by “that type of organization.” It also contradicts federal regulation.

First, in defining “financial statement transparency,” the proposal requires any nonprofit desiring to do business with the county to undergo an external audit. While an external audit is good business practice, it is widely understood to be both unnecessary and prohibitively expensive for the vast majority of nonprofit organizations.

First, in defining “financial statement transparency,” the proposal requires any nonprofit desiring to do business with the county to undergo an external audit. While an external audit is good business practice, it is widely understood to be both unnecessary and prohibitively expensive for the vast majority of nonprofit organizations.

As part of this audit process, the proposal mandates that nonprofits would have to disclose their donors for the two years prior to and following fund disbursement. That requirement is neither standard audit practice nor would any certified public accounting firm abide by it. More importantly, IRS regulations specifically exclude the list of donors and their addresses filed with Form 990 from the information that must be disclosed for public inspection, with the exception of donors to private foundations and Section 527 political organizations.

Finally, the amendment stipulates that if a nonprofit exercises its right to advocate for change to any aspect of the Whatcom County Code or Charter — either directly or indirectly — that nonprofit would be ineligible to do business with the county for 10 years.

It would be easy to characterize this as another controversial way to fray community – cut from the same cloth as “religious freedom” or voter ID laws. Regardless, it is precisely these types of local policy issues that remind us of the key role philanthropy plays in strengthening our democracy, protecting the public good and building resilient, equitable and inclusive communities.

Comments

Thanks for the thoughtful

Thanks for the thoughtful response. I run the Bellingham Food Bank and the cohort on the Charter Review Commission are truly frightening and are targeting non-profits, keen to limit Whatcom County government's ability to contract with any. It's not a fun fight.