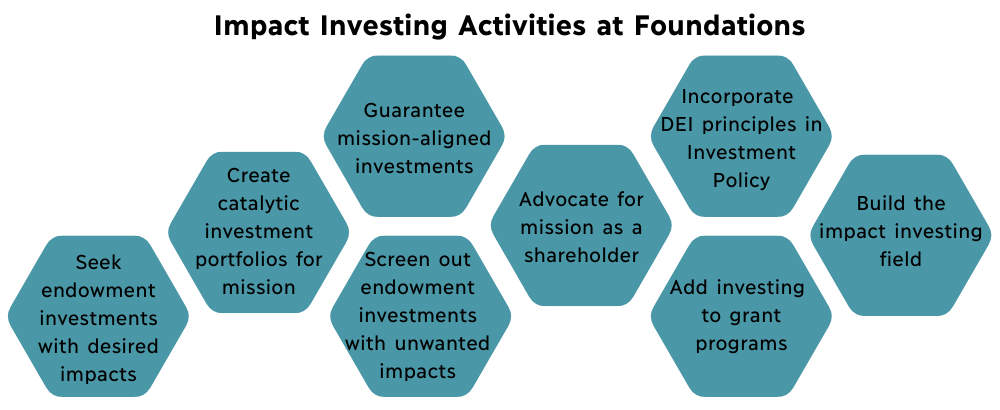

Impact investing is a bundle of practices that allow asset owners like foundations to invest for financial returns while also achieving mission impact. This strategy can complement and amplify all of the foundation’s other activities, such as grantmaking, communications and convening. It can take a mission-neutral asset like the endowment, and actively use it to advance the foundation’s core purpose.

Within the endowment, impact investing allows a foundation to consider mission results along with financial returns when choosing funds, fund managers, strategies and endowment holdings. The foundation can avoid investments whose impacts run counter to its values and mission, and it can prioritize investments that advance their values and mission. Foundations that adopt impact investing frequently incorporate racial, social and gender equity into the principles of their investment policy statements.

As they adopt these impact investing tools, foundations seek good financial returns that fund the spending policy and meet perpetuity goals. You can hear more about the experience and impact of shifting investing practices from foundation leaders in this video.

Because foundations are rooted in a tax-exempt, mission-based business structure, they are natural leaders in impact investing. The cumulative influence and demand from foundations has sparked the establishment of specialized impact investment advisor firms. Foundation demand has supported innovation and growth of mission-based investing opportunities in every asset class. And most recently, foundations are working to dismantle injustices in investing systems that are related to race, gender and social class.

A Thriving Regional Ecosystem

The Northwest has a thriving impact investing ecosystem, which we champion in Philanthropy Northwest’s network, programs and publications. Below are our members and partners that have active impact investing programs:

| The Annie E. Casey Foundation | Ben B. Cheney Foundation | Bill and Melinda Gates Foundation | Canopy |

| Empire Health Foundation | Enterprise | Ford Foundation |

Greater Tacoma Community Foundation |

| Meyer Memorial Trust | Northwest Area Foundation | The O.P. and W.E. Edwards Foundation | Rasmuson Foundation |

| The Russell Family Foundation | Seattle Foundation | Whatcom Community Foundation |

Growing Impact Investing in the Pacific Northwest

Philanthropy Northwest is committed to building capacity and supporting foundations to use impact investing. Start strengthening your impact investing efforts today by getting involved with the services and projects below.

|

Impact Investing Consulting Services Our consulting team at The Giving Practice offers a full suite of services to help you explore, launch or deepen an impact investing program. We can:

Philanthropy Northwest welcomes questions from members about impact investing. To arrange a no-cost consultation, please contact our Membership Director, Danielle Crystal. |

Impact Investing Resources

Find some of our publications geared specifically to foundations and foundation investment committee collaboratives below.